Calculating 401k contribution from paycheck

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

How Much Can I Contribute To My Self Employed 401k Plan

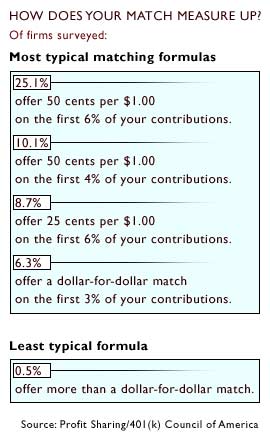

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to.

. Strong Retirement Benefits Help You Attract Retain Talent. Ad If you have a 500000 portfolio download your free copy of this guide now. About half of employers who offer a 401k offer this variation.

We use the current maximum contributions 18000 in 2015 and 53000 including company. The most you can contribute in 2019 is 19000 and those age 50. First all contributions and earnings are tax-deferred.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Divide 72000 by 12 to find your monthly.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. This calculator has been. For example lets assume your employer.

Ad Maximize Your Savings With These 401K Contribution Tips From AARP. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. According to the IRS you can contribute up to 20500 to your 401 k for 2022.

Retirement Calculators and tools. If you increase your contribution to 10 you will contribute 10000. Use our retirement calculator to see how much you might save by the.

This number only accounts for the. Your contributions are made after taxes but distributions in retirement are not taxed as income. By comparison the contribution limit for 2021 was 19500.

401k contribution paycheck calculator Senin 12 September 2022 Edit. 401 k Contribution Calculator. You only pay taxes on contributions and earnings when the money is withdrawn.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan.

If you increase your contribution to 10 you will contribute 10000. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Most retirement experts recommend you contribute 10 to 15 of your income toward your 401 each year.

When you make a pre-tax contribution to your. Plan For the Retirement You Want With Tips and Tools From AARP. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay.

It provides two important advantages. This calculator uses the latest. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace.

Payroll 401k and tax. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

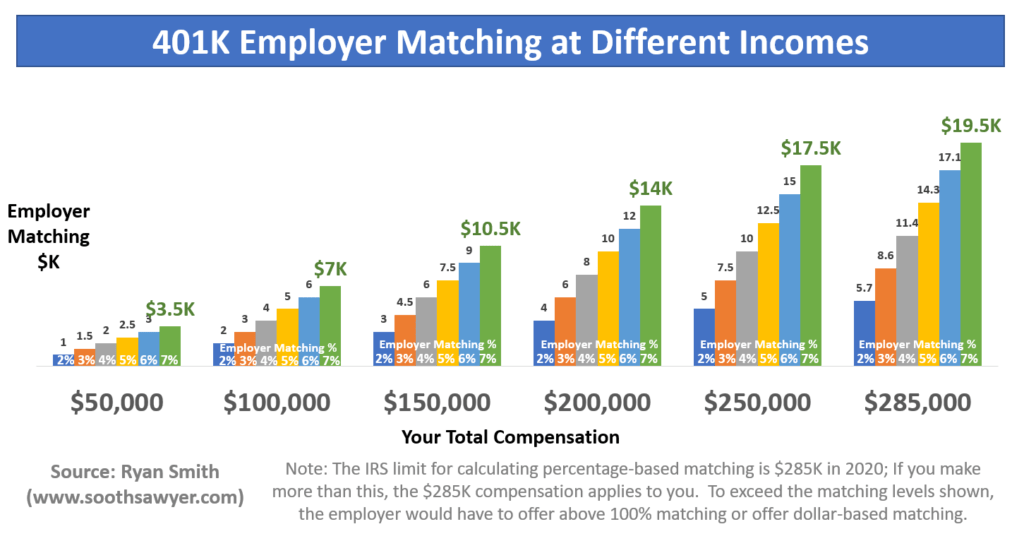

This is the maximum percent of your salary matched by your employer regardless of the amount you decide to contribute. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. This guide may be especially helpful for those with over 500K portfolios.

Your employer needs to offer a 401k plan. Please note that your. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees.

Solo 401k Contribution Limits And Types

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

What Is A 401 K Match Onplane Financial Advisors

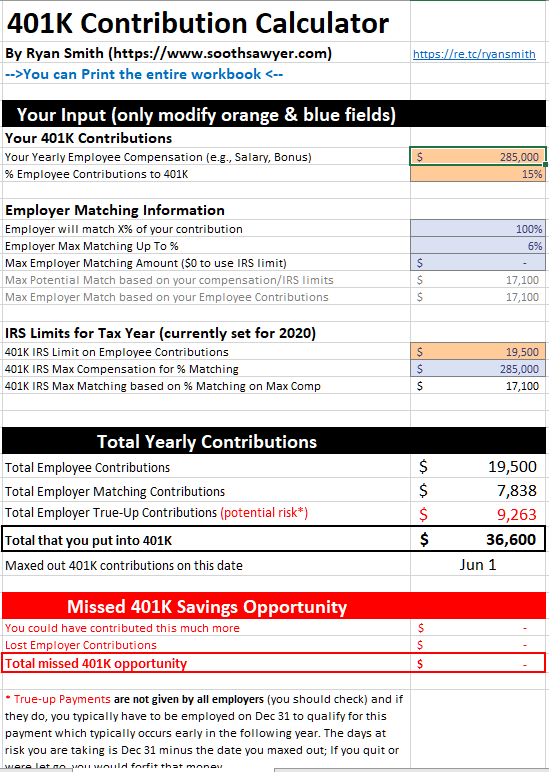

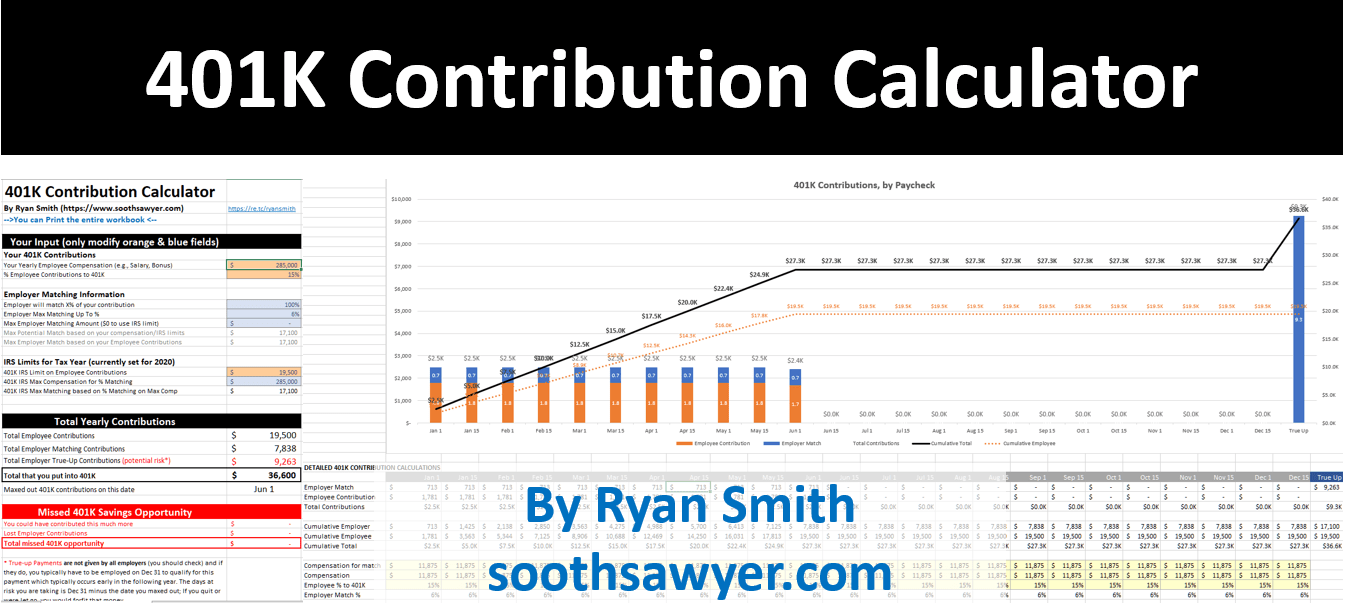

401k Employee Contribution Calculator Soothsawyer

401 K Plan What Is A 401 K And How Does It Work

The Maximum 401 K Contribution Limit For 2021

401k Employee Contribution Calculator Soothsawyer

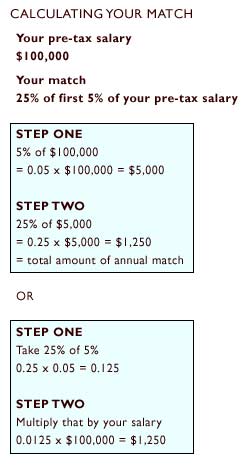

Doing The Math On Your 401 K Match Sep 29 2000

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

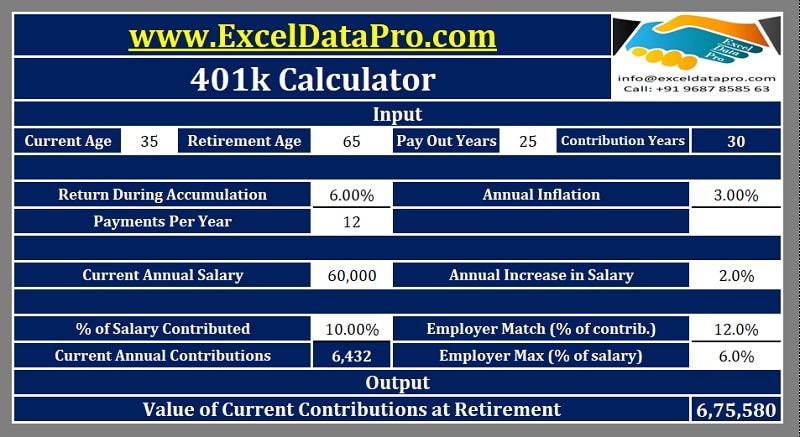

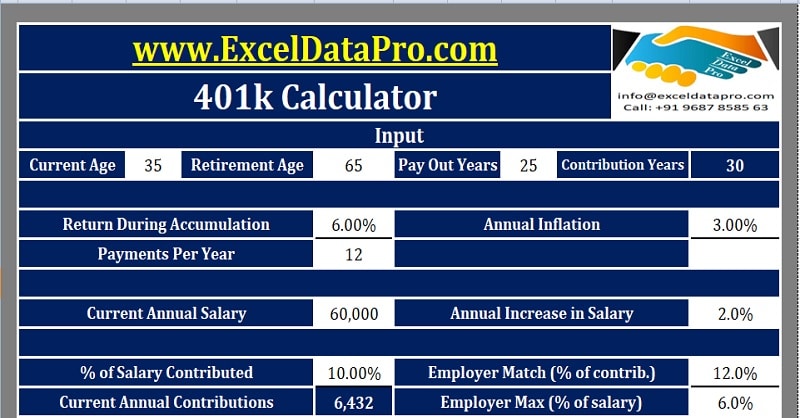

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

Excel 401 K Value Estimation Youtube

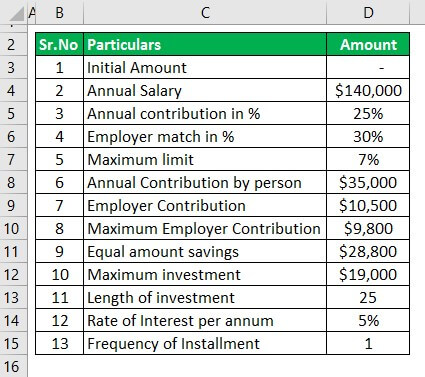

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

Doing The Math On Your 401 K Match Sep 29 2000

The Maximum 401k Contribution Limit Financial Samurai